Thursday, December 4, 2008

No Layoffs for CEOs

If overall unemployment rose by the same percentage from October to November, then the unemployment rate ought to have been about 7.4 percent last month, the highest level in about 15 years. Of course, the feds can tinker with labor force numbers and seasonal adjustments (November normally is a month that sees strong hiring in anticipation of the holiday retail season) and the actual reported unemployment rate may not be that bad; the Wall Street consensus is for a figure of just 6.7 percent, up from 6.5 percent in October.

Not contributing significantly to whatever increase does get reported will be the top executives of America’s largest publicly traded corporations, because layoffs never extend to the boardroom no matter how bad a job the managers have been doing. On the other side of the coin, the trillion-dollar-plus economic rescue plan to date hasn’t come anywhere near helping the average worker.

So who has it helped? Well, we might suppose that the shareholders of the nation’s biggest financial companies have benefited; those companies, which have been the biggest recipients of our money, might well have seen their shares fall even lower than they are now if Messrs. Paulson and Bernanke hadn’t generously shoveled our money into their vaults.

And just who are those shareholders? Regular folks like you and me, who’ve saved a penny here and there and patriotically invested in the companies that make America great, right? Um, no, not so much.

Bank of America, for example, the country’s biggest banking firm, is 55.5 percent owned by “institutions,” meaning other banking firms, big Wall Street brokerage houses and, yes, some pension funds and mutual fund companies. Citigroup is 63.3 percent institionally owned, and struggling insurer American International Group is 55.9 percent owned by institutions.

Just which institutions are they? In fact, it’s a pretty cozy little group: Of the top 25 holders of each of these three companies as of Sept. 30, 15 are the same ones in all three cases. Here’s the list:

AXA

Bank of New York Mellon

Barclays Global Investments

Barrow Hanley Mewhinney & Strauss

Brandes Investment

Capital Research Global

Capital World Investment

Deutsche Bank

FMR LLC

Geode Capital Management

Goldman Sachs Group

Northern Trust Corp.

T. Rowe Price

State Street Corp.

Vanguard Group Inc.

Note in particular that Goldman Sachs is the big brokerage house that used to be headed by Daddy Warbucks, I mean Henry Paulson.

This sort of thing helps explain why executives of these kinds of companies continue to receive unconscionable “compensation” packages no matter how the companies perform: because the biggest shareholders and the “independent” directors are all members of the same club or subculture. If anyone started holding one of them to reasonable standards, they’d all be in trouble.

Tuesday, December 2, 2008

Bernanke Must Go

According to McCarthy, pigs are mostly insensitive to temperature except in their snouts. In Minnesota, where McCarthy was from, it gets pretty cold, of course. But because pigs mainly sense temperature with their snouts, as long as their snouts are warm, they believe they’re warm all over. So when a pig gets cold, McCarthy said, it will try to warm itself up by sticking its snout between the hind legs of another pig.

According to McCarthy, it’s not unheard-of to see whole herds of swine forming a kind of daisy chain, each with its nose up the backside of the one in front of it. And if there’s an unexpected hard freeze, an unfortunate pig farmer might come out the next morning to find his entire herd frozen to death in a circle.

McCarthy shared this somewhat indelicate information as a metaphor for the behavior of politicians, but it also strikes me as highly applicable to the way financial regulators and executives have been behaving lately.

Take, for instance, Federal Reserve Chairman Ben Bernanke. Throughout the first half of this year, Bernanke insisted that the U.S. economy was not in a recession and stood a fair chance of avoiding one. While he acknowledged that the economy was weak and the financial system vulnerable because of mortgage-related problems, he expressed confidence that the Fed’s cuts in its key interest rate would be enough to prevent an actual economic decline.

We know now, of course, that Bernanke was wrong. According to the National Bureau of Economic Research, a private nonprofit business group that is the quasi-official authority on economic cycles, the U.S. entered a recession a year ago this month.

What’s more, a lot of people have known that all along; even an armchair economist like me. Back on April 23, I wrote in my blog for The Post and Courier that “it would appear likely that we’ll look back at the fourth quarter of 2007 as the beginning of this recession.”

But Bernanke – who holds his job as Fed chairman because he’s regarded as one of the nation’s top economists – continued to insist that there was no recession and that a recession could, in fact, be avoided.

There are only two possible reasons why Bernanke kept saying those things: Either he’s an incompetent economist or he was being deliberately deceptive.

I’d probably opt for the latter explanation, because there does seem to be a kind of traditional belief in the financial community that denial of negative conditions will somehow make those conditions go away. (The real estate community took a somewhat similar approach early in the ongoing collapse of that market.) And there’s also the Straussian belief, widespread in the Bush administration, that deception of the citizenry is a valid policy tool.

However, it doesn’t matter which explanation you prefer. Either way, it’s clear that we have no good reason to trust Bernanke as a steward of our economy and financial system.

Bernanke’s partner in the ongoing economic Tweedledum and Tweedledee act, Henry Paulson, will be leaving office in January as part of the turnover of the White House to Barack Obama’s team. But Bernanke’s 4-year term as chairman of the Fed doesn’t expire until January 2010, and his 14-year (!) term on the Fed’s board will last until 2020.

The totally inadequate response of Bernanke and Paulson to the current economic and financial problems is reason enough to want them both gone. But now that we have clear, decisive evidence of Bernanke’s unreliability even on the level of Economics 101, it’s imperative that he be replaced as rapidly as possible.

Bernanke should do the honorable thing and resign, now. And if he won’t do that, then the new administration and the new Congress should do whatever is necessary to dismiss him for incompetence. All he has done is try to keep financial executives’ noses warm, but the economic temperature is still dropping.

Friday, November 28, 2008

More Trouble Ahead?

However, as of Friday, my short-term indicators were showing that the Dow has in fact moved into “overbought” territory. That’s not very worrisome in itself; these indicators almost always hit steeply overbought levels on any rebound from a sharp decline, and they can remain in overbought territory for some time while the index continues to post new highs for the move. But it’s at least a sign that the strongest gains for this move may already have been made and there may be some degree of pullback due.

Possibly more troubling is a divergence between the Dow industrials and the Dow transportation average. Back in the spring, in my former blog for The Post and Courier (which I gather has now been taken offline), I identified a Dow Theory sell signal after the transports hit a new all-time high while the industrials remained well below their own record high. The current situation isn’t nearly as significant, but it may be another signal that a downdraft lies ahead: The industrials as of today are back above all their October lows, while the transports remain below the short-term lows set on Oct. 9 and 15. In other words, the transports haven’t recouped as much of their losses as the industrials have.

Last spring, I was wondering how it was possible for the transportation average to rise to an all-time high at the same time fuel prices were doing the same thing; now I’m wondering why the transports are looking weaker than the industrials at a time when fuel prices have been falling pretty hard. It strikes me as an imbalance with at least modestly bearish implications.

There are plenty of possible news hooks due next week that could spark a decline, but the one that analysts and economists are the most worried about is Friday’s report on the national employment situation for November. Given the increases in weekly initial claims for unemployment insurance this month, it’s likely the unemployment rate will have risen substantially.

Of course, that’s already bad news for people who’ve lost their jobs, but from the perspective of economists and brokerage house analysts, the report will be bad news because it will suggest that “consumers” (who of course are mostly workers) will be spending less in the weeks and months ahead, further hampering corporate profits. I’ve never figured out why the bean-counters and MBAs always want to respond to slower sales by cutting jobs and then can’t seem to understand why their sales drop even more, but I expect we’ll be seeing more of that kind of head-scratching next week.

Wednesday, November 26, 2008

Off Balance

Some of the financial media are attributing the gains to “bargain-hunting,” or speculative buying of beaten-down shares in the belief that the selloff of the past several weeks was overdone. But that strategy would have to be based on an additional belief that the economy won’t continue to deteriorate, and I don’t see much indication that any such belief is widely held (whether true or not).

Another possible cause of the rebound: Maybe investors have decided that the steps being taken by Washington to stem the economic washout will actually work, finally – at least as far as Wall Street’s needs are concerned.

For example, this week Treasury Secretary and former Goldman Sachs CEO Henry Paulson announced that we (you and me, taxpayers) are going to give the nation’s fourth-largest banking company, Citigroup, an additional $300 billion in loan guarantees and a $45 billion cash infusion, on top of the $25 billion we already handed them in the first round of “TARP” investments, which of course did us no discernible good.

Citigroup, as of Sept. 30, reported total assets of $2.05 trillion. You would think that might be enough to enable them to cover their own bad bets. And indeed, the company reported total liabilities of just $1.92 trillion, leaving them with $126.1 billion in stockholder equity.

However, like many other large financial companies, Citigroup has what it refers to (in its latest financial filing with the Securities and Exchange Commission) as “off-balance-sheet arrangements.” As the name implies, these “arrangements” enable companies to take liabilities off their balance sheets by setting up a separate business entity, called a “special-purpose entity,” or SPE. The liabilities are, as Citigroup explains, “recorded on the balance sheet of the SPE and not reflected on the transferring company's balance sheet, assuming applicable accounting requirements are satisfied.” Although SPEs were used by the notorious Enron Corp. to deceive investors and regulators, they’re perfectly legal when used appropriately.

So how much has Citigroup taken “off-balance-sheet” by this method? Again, according to its latest filing with the SEC, the company’s “total involvement” in off-balance-sheet arrangements was $1.29 trillion at the end of September.

Now, it’s very unclear how much of that “involvement” might end up back on Citigroup’s balance sheets if it were required to “consolidate” it, as the Financial Accounting Standards Board has suggested it might decide to decree. But just for the sake of argument, if we suppose that the company were forced to put the whole amount back on its statement of liabilities, the effect would be to drop its stockholder equity from a positive $126.1 billion to a negative $1.16 trillion.

Based on its officially reported positive equity, Citigroup currently has stockholder equity per share, or “book value”, of $23.13. In normal times, stocks of major companies customarily sell for a multiple of book value, but Citigroup’s shares currently are trading below book value. Today’s close, $7.05, was just 30 percent of reported book value; at the low on Friday, before the latest handout was announced, the stock closed at just 16 percent of book value.

On the other hand, if my hypothetical numbers above were used, Citigroup would have a book value of minus $212.87 per share.

So maybe the reason Citigroup’s shares are selling below reported book value is that investors are worried that Citigroup may, indeed, have to “consolidate” some significant portion of its off-balance-sheet liabilities, which would mean its current reported book value is a wee bit unrealistically high. And maybe that has something to do with why our Secretary of Wall Street is so anxious to hand the company big piles of our money.

Tuesday, November 25, 2008

All Outside

“Western man is held in thrall by the ‘ten thousand things;’ he sees only particulars, he is ego-bound and thing-bound, and unaware of the deep root of all being. ... The Western attitude, with its emphasis on the object, tends to fix the ideal – Christ – in its outward aspect and thus to rob it of its mysterious relation to the inner man.”

“Christ the ideal took upon himself the sins of the world. But if the ideal is wholly outside, then the sins of the individual are also outside, and consequently he is more of a fragment than ever, since superficial misunderstanding conveniently enables him, quite literally, to ‘cast his sins upon Christ’ and thus evade his deepest responsibilities – which is contrary to the spirit of Christianity. ... If the supreme value (Christ) and the supreme negation (sin) are outside, then the soul is void: its highest and lowest are missing.”

“It may easily happen ... that a Christian who believes in all the sacred figures is still undeveloped and unchanged in his inmost soul because he has ‘all God outside’ and does not experience him in the soul. His deciding motives, his ruling interests and impulses, do not spring from the sphere of Christianity but from the unconscious and undeveloped psyche, which is as pagan and archaic as ever. The great events of our world as planned and executed by man do not breathe the spirit of Christianity but rather of unadorned paganism. ... Christian civilization has proved hollow to a terrifying degree: it is all veneer, but the inner man has remained untouched and therefore unchanged. His soul is out of key with his external beliefs; in his soul the Christian has not kept pace with external developments. Yes, everything is to be found outside – in image and in word, in Church and Bible – but never inside. Inside reign the archaic gods, supreme as of old. ...”

“The Christian missionary may preach the gospel to the poor naked heathen, but the spiritual heathen who populate Europe have as yet heard nothing of Christianity. Christianity must indeed begin again from the very beginning if it is to meet its high educative task. So long as religion is only faith and outward form, and the religious function is not experienced in our own souls, nothing of any importance has happened. It has yet to be understood that the mysterium magnum is not only an actuality but is first and foremost rooted in the human psyche. The man who does not know this from his own experience may be a most learned theologian, but he has no idea of religion ....”

Sunday, November 23, 2008

Imagine This

Imagine such a world if you can, if you wish – and then forget it.

The world in which we actually live is very different from Paradise. People die daily, many for the wrong reasons. We all suffer pain. Everything physical passes into nonbeing, so we inevitably lose whatever we have, and anyone or anything we love will be ripped away from us sooner or later. The seasons change, the world rolls along its complicated path, and we take from it what we must have, if we can.

Accepting that we live in such a world is wisdom. Believing that we can live in the imaginary world of endless, perfect self-gratification is foolishness.

The Founding Fathers of the United States were philosophers. There’s an important distinction to be found in the words of the Declaration of Independence: “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable rights, that among these are life, liberty and the pursuit of happiness.”

The distinction is this: We have a right to pursue happiness, but not a right to be happy.

Further, each of us has a right to define happiness.

But if we decide to define happiness as Paradisal existence, free of any of the consequences that common sense would admit are integral to human existence, then we are asking too much. What we must acquire and spend to obtain such a life is too costly for ourselves and everyone around us. My Paradise creates your Hell.

Thursday, November 20, 2008

'Tis the Season

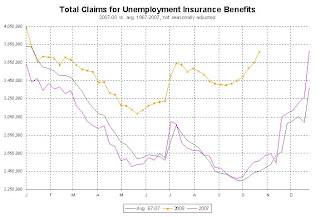

The news tickers and financial correspondents are, as usual, reporting the Labor Department’s headline number: 542,000 initial filings for benefits, up from 516,000 the previous week and the highest level since 1992. Pretty shocking stuff, if it were real. Here’s a chart (click to enlarge, right-click to open in its own window) showing the true situation:

The headline number is of course the “seasonally adjusted” figure for initial claims. What the chart shows, in contrast, is the actual number of filings this year to date compared with last year and the average going back to 1967. And the actual number of filings, 511,941, was down in the latest week, not up.

That’s not to say that the employment situation is rosy. The latest number is in fact the second-highest for the corresponding week since record-keeping began; the highest was in 1982. And the total is 58 percent above the corresponding week last year, which, as the chart shows, was actually a little below the long-term average. But there’s no surprise here; the unadjusted figures this year have been running sharply higher than last year since February (with one week in July marking an exception).

Adding in continued claims, which are reported a week later than initial claims, the situation looks pretty bad:

The latest number for this series is 53 percent above the same week last year and, like the initial claims number, is the second-highest on record for the corresponding week, with 1982 marking the peak. And again, filings this year have steeply outpaced last year for pretty much the whole year, so I’m having a little trouble understanding why this is all such a shock to the talking heads on TV.

In both charts, this year’s filings have been following the long-term seasonal pattern quite closely but at an exceptionally high level. If the numbers continue that pattern, it’s not good news for workers, because the seasonal tendency is for layoffs to increase sharply until mid-January. Given the effect the economic slowdown is already having on retailers, car dealers and just about everyone else, it’s not good news for anyone.

Wednesday, November 19, 2008

It Could Be Worse

The Dow Jones Industrial Average is down, as of today’s close, 44 percent from its all-time high set a little over a year ago. The decline from the January 1973 high to the December 1974 low was 45 percent. The decline from the September 1929 high to the July 1932 low was almost exactly twice as much, 89 percent. An 89 percent decline from the October 2007 high would put the Dow at about 1558, so today’s much-discussed close slightly below 8000 may not look quite so bad.

Mathematically, stock market movements resemble earthquakes; that is, they’re fractal and scale according to a power law. In oversimplified English, which is the only way I can understand this kind of thing, what that means is that exponentially larger movements occur exponentially less often than small movements. This is why seismologists are unable to tell Californians exactly when “the Big One” will occur but insist that the more time passes without a big one, the more likely it becomes. So same thing with the stock market.

The current bear market is the second since 2000; the decline from the January 2000 high to the October 2002 low amounted to about 38 percent. From the seismological point of view, that might mean that we’re less likely to get a “big one” of near 90 percent, and instead must suffer through a series of less catastrophic but still thoroughly unpleasant medium-sized shocks.

From the standpoint of technical market analysis, 8000 on the Dow isn’t very interesting anyway. The really interesting number is the October 2002 low at about 7286, which we could stretch a bit down to the 7000 level as an idealized 50 percent decline. If that range doesn’t hold, then we’re potentially looking at a decline to 1.) the 5300-5700 area, representing the trading range of a 1996 pause, for a possible 62 percent drop; the 3600-4000 range, which is the level of a somewhat significant sideways move in 1994 and would amount to a roughly 75 percent decline; or the aforementioned near-90 percent decline to the 1500 range. And of course there's always the possibility that the world could come to an end and the Dow would fall to zero, but personally I give that pretty low odds.

Those are, of course, the worst-case scenarios. The most optimistic case would be that the market is “base-building” right around where it is now and will launch a new, multi-year uptrend from here that will replenish all the 401(k) accounts and other investments that have been stripped in the past year. I’d feel a lot more confident about that scenario if it didn’t depend so much on believing that the same people who contributed so much to the current problems - and who are still apparently more interested in self-justification and self-aggrandizement than in doing anything for their society or their world - will somehow suddenly start making all the right decisions.

CPI Update

Monday, November 17, 2008

The Price of Everything

Wall Street forecasters on average are predicting the CPI fell in October by 0.7 percent after zero change in September, and are looking for October’s year-on-year increase to be 4.0 percent after a 4.9 percent rise in September.

Those estimates are based on the seasonally adjusted index, of course. I’ve been looking at the unadjusted figures going back to 1913, and frankly I don’t see any evidence of strong seasonal tendencies in this index, which is already kind of overprocessed without adding seasonal assumptions to the brew. And I’m not even going to talk about the inane “core” inflation concept, which excludes food and energy prices, allegedly because of their “volatility.”

In any case, one group that ought to be paying close attention to these numbers, adjusted or not, is the Federal Reserve’s interest rate-setting Open Market Committee. The minutes from that august body’s latest meeting are due for release Wednesday afternoon. Given that the FOMC opted at that meeting to cut the Fed’s main interest rate again, it seems likely that they decided (again) that inflation isn’t much of a threat right now.

I’d say the following chart argues otherwise:

What the chart (click on it to enlarge; right click to open in a new window) shows is pretty straightforward, with no massaging or processing: It’s the CPI, not seasonally adjusted, going back to 1990.

The top line of the orange-colored trend channel actually connects all the way back to a big spike in inflation that resulted from war-related shortages – World War I, that is. So as a growth rate, it generally represents the maximum rate of increase in inflation over a period of about 90 years.

But as you can see toward the right side of the chart, the CPI’s rate of increase accelerated at the beginning of 2004, as indicated by the red trend channel. By the middle of 2005, the index had actually broken above the 90-year top trendline. And by April of this year, it outpaced even the new, faster rate of increase, as indicated by its breach of the upper red line.

The all-time high in the index was set this past July, and the index has declined slightly since then. As mentioned above, the forecasters on Wall Street believe it fell again in October, and if there’s any seasonal tendency in this index, it’s toward an easing of the rate of increase during the fourth quarter. If the prediction of a 0.7 percent dip is correct, it will be the biggest monthly drop in the CPI (seasonally unadjusted) since November 2005. But it won’t be enough to drop the index below the top red line on the chart, let alone to bring it back into the long-term trend channel.

For some time now, high inflation combined with an economy in recession – “stagflation,” to use the term coined in the 1970s – has been the ultimate nightmare scenario for policymakers, politicians and investors. The Fed clearly thinks it has a better chance of warding off recession, by cutting interest rates, than of cooling off inflation, which would require raising interest rates. But if the rate cuts don’t keep the economy from declining – and so far, they obviously haven’t, as the latest gross domestic product numbers attest – they still stand a good chance of keeping inflation climbing.

Sunday, November 16, 2008

Illiteral

So I’ll say simply that the fundamentalists’ claim that they interpret the Bible literally is false, or at least is only true some of the time – that is, when it suits them.

For example, we’ve all heard about TV evangelists’ use of the law of Moses to condemn homosexuality and anything else they don’t like. And anyone who belongs to a conservative Christian denomination is familiar with the use of the law to justify the practice of “tithing,” or donating one-tenth of one’s income to the church.

So how do those ministers justify those appeals to the ancient law of Israel if they take a literal view of these words from Paul’s letter to the Galatians (chapter 2, verses 16-21):

“Knowing that a man is not justified by the works of the law, but by the faith of Jesus Christ, even we have believed in Jesus Christ, that we might be justified by the faith of Christ, and not by the works of the law: for by the works of the law shall no flesh be justified. But if, while we seek to be justified by Christ, we ourselves also are found sinners, is therefore Christ the minister of sin? God forbid. For if I build again the things which I destroyed, I make myself a transgressor. For I through the law am dead to the law, that I might live unto God. I am crucified with Christ: nevertheless I live; yet not I, but Christ liveth in me: and the life which I now live in the flesh I live by the faith of the Son of God, who loved me, and gave himself for me. I do not frustrate the grace of God: for if righteousness come by the law, then Christ is dead in vain.”

Or these from Paul’s letter to the Romans (chapter 7, verses 4-6):

“Wherefore, my brethren, ye also are become dead to the law by the body of Christ; that ye should be married to another, even to him who is raised from the dead, that we should bring forth fruit unto God. For when we were in the flesh, the motions of sins, which were by the law, did work in our members to bring forth fruit unto death. But now we are delivered from the law, that being dead wherein we were held; that we should serve in newness of spirit, and not in the oldness of the letter.”

Returning to Galatians (chapter 5, verses 1-4), we find Paul issuing a specific warning to some early Christians who believed they needed to adhere to one particular point of the ancient law:

“It was for freedom that Christ set us free; therefore keep standing firm and do not be subject again to a yoke of slavery. Behold I, Paul, say to you that if you receive circumcision, Christ will be of no benefit to you. And I testify again to every man who receives circumcision, that he is under obligation to keep the whole Law. You have been severed from Christ, you who are seeking to be justified by law; you have fallen from grace.”

It seems to me that Paul’s warning can be applied in reverse to those who pick and choose among the laws of Moses to rationalize tithing or to condemn practices they disapprove of: You are under obligation to keep the whole law. So you need to start keeping kosher, and you need to make an appointment with your local mohel or mohelot.

Friday, November 14, 2008

Darwin vs. Darwinism

I’ve done a little chipping away in this blog at the fixed positions on both sides of this polarized debate, and while I’m not interested in a frontal assault on either position (I was raised literally in the middle of a Civil War battlefield, so I know the futility of that tactic, even if I hadn’t read Sun Tzu), I want to step up the opposition to the hijacking of our intellectual life by extremists.

So here’s the first barrage:

One of the great crises of spirituality in the Western world was precipitated by the publication in 1859 of Charles Darwin’s book “On the Origin of Species by Means of Natural Selection, or the Preservation of Favoured Races in the Struggle for Life.” The spritual crisis was precipitated by the fact that because this work seemed to imply that a literal interpretation of Judeo-Christian scripture was erroneous, there was a widespread belief that “Darwin has disproven the Bible.” As a result, some people abandoned their Christian faith and others hardened theirs. (This was, in fact, what gave birth to the fundamentalist movement, which originated among a group of Baptist ministers who decided that the best answer to the challenge of science to the scriptures was to declare the scriptures right and science wrong.)

Interestingly, the word “evolution” doesn’t appear anywhere in the first edition of Darwin’s book. In fact, the only place in it where any form of the word “evolve” can be found is at the end, the final word of the final sentence of the book:

“It is interesting to contemplate an entangled bank, clothed with many plants of many kinds, with birds singing on the bushes, with various insects flitting about, and with worms crawling through the damp earth, and to reflect that these elaborately constructed forms, so different from each other, and dependent on each other in so complex a manner, have all been produced by laws acting around us. These laws, taken in the largest sense, being Growth with Reproduction; Inheritance which is almost implied by reproduction; Variability from the indirect and direct action of the external conditions of life, and from use and disuse; a Ratio of Increase so high as to lead to a Struggle for Life, and as a consequence to Natural Selection, entailing Divergence of Character and the Extinction of less-improved forms. Thus, from the war of nature, from famine and death, the most exalted object which we are capable of conceiving, namely, the production of the higher animals, directly follows. There is grandeur in this view of life, with its several powers, having been originally breathed into a few forms or into one; and that, whilst this planet has gone cycling on according to the fixed law of gravity, from so simple a beginning endless forms most beautiful and most wonderful have been, and are being, evolved.”

In the sixth edition, published in 1872, “evolution” is much more prominent, mainly in describing Darwin’s supporters and his responses to his critics. For example: “It is admitted by most evolutionists that mammals are descended from a marsupial form; and if so, the mammary glands will have been at first developed within the marsupial sack.”

In short, during the 13 years since the publication of the first edition of “Origin of Species,” Darwin has shifted from making observations of nature and drawing conclusions from them to defending his theories against the onslaughts of his many critics – mainly the religious establishment – and aligning himself with partisans who support him.

Given that there were so many who believed that “Darwin has disproved the Bible” and more generally that “Science has disproved God,” it’s interesting that Darwin made only one small change to that final paragraph reproduced above. Here it is again, with the one small change highlighted:

“It is interesting to contemplate a tangled bank, clothed with many plants of many kinds, with birds singing on the bushes, with various insects flitting about, and with worms crawling through the damp earth, and to reflect that these elaborately constructed forms, so different from each other, and dependent upon each other in so complex a manner, have all been produced by laws acting around us. These laws, taken in the largest sense, being Growth with reproduction; Inheritance which is almost implied by reproduction; Variability from the indirect and direct action of the conditions of life, and from use and disuse; a Ratio of Increase so high as to lead to a Struggle for Life, and as a consequence to Natural Selection, entailing Divergence of Character and the Extinction of less improved forms. Thus, from the war of nature, from famine and death, the most exalted object which we are capable of conceiving, namely, the production of the higher animals, directly follows. There is grandeur in this view of life, with its several powers, having been originally breathed by the Creator into a few forms or into one; and that, whilst this planet has gone circling on according to the fixed law of gravity, from so simple a beginning endless forms most beautiful and most wonderful have been, and are being evolved.”

Thursday, November 13, 2008

Spin Cycle

Um, no. In the U.S. at least, the organization that more or less officially declares when recessions begin and end, the National Bureau of Economic Research, defines a recession “technically” like this:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. A recession begins just after the economy reaches a peak of activity and ends as the economy reaches its trough.”

In practical terms, most recessions do include two or more consecutive quarters of declining GDP, but a recession can start or end during a quarter that shows an overall increase. As the NBER puts it:

“Most of the recessions identified by our procedures do consist of two or more quarters of declining real GDP, but not all of them. The most recent recession in our chronology was in 2001. According to data as of July 2008, the 2001 recession involved declines in the first and third quarters of 2001 but not in two consecutive quarters. Our procedure differs from the two-quarter rule in a number of ways. First, we consider the depth as well as the duration of the decline in economic activity. Recall that our definition includes the phrase, "a significant decline in economic activity." Second, we use a broader array of indicators than just real GDP. One reason for this is that the GDP data are subject to considerable revision. Third, we use monthly indicators to arrive at a monthly chronology.”

So far, the NBER hasn’t declared that the U.S. economy is in a recession, but they’re often a little slow to make such determinations; it wasn’t until July 2003 that they decided the 2001 recession had ended in November of that year.

Interestingly, the NBER body that makes these determinations is called the Business Cycle Dating Committee. Until recently, a casual observer of the talk coming out of Wall Street and Washington might have gotten the idea that the “business cycle” was a thing of the past, there would be no more downturns, just an endless vista of rising prosperity until the end of time, because our god-like regulators and CEOs would exercise their miraculous powers to make it so.

These of course would be the same regulators and CEOs who are now running hysterically around seeking taxpayer handouts and warning of the imminent collapse of our entire economic system if they don’t get them.

Cycles play a large role in the natural order and are often related to the kind of yin-yang/creation-destruction/attraction-repulsion systems found widely in philosophy and physical science. Given the fundamental dualism of financial and economic dynamics (buy or sell), it would be pretty surprising if we didn’t see some evidence of cyclicality in the economy and markets.

Well, no surprise here:

The chart shows the daily closing price of the Dow Jones Industrial Average from 1897 to the present, on log scale (click to enlarge). The gridlines are set to a time interval of three and a quarter years, and as you can see if you look closely, many of the most significant lows in the index occur pretty close to those lines.

That cycle is even clearer in this next one:

What this chart shows is the 52-week average of the daily percentage price change in the Dow over the same period shown in the first chart. The cyclicality in this time series is pretty obvious, though it clearly isn’t precise enough to be useful in making investment forecasts.

Possibly the most interesting thing about this chart is the fact that the Oct. 27 low in the Dow at 8175 came just seven days shy of the exact predicted date for the 3.25-year cycle low. The index and the average rate of change both rebounded from that point, possibly signaling the start of an upswing that could last a year or more. However, for that interpretation to retain any validity, the index will have to stay above the 8175 level; it’s succeeding so far, but just barely.

Tuesday, November 11, 2008

Reasonably Irrational

Put simply, economists believe that economies and markets function efficiently because people naturally choose the courses of action that are most likely to give them the greatest benefit. In this obviously naive belief, economists are clinging to the ideas of those theorists of the so-called Age of Reason, such as John Locke and Adam Smith, who laid the foundations of our modern political and economic systems. For Locke and Smith and their like-minded contemporaries, “reason” alone is sufficient to guide all human life and unlock all the mysteries of existence, while “unreason” is all bad and a great impediment to our progress as individuals and as a society.

In particular, the thinkers of the 18th-century “Enlightenment” – many of them Deists, including a number of the founding fathers of the United States – identified “unreason” with traditional and “emotional” forms of religion. After all, they were keenly aware of the violent upheavals of the 15th and 16th centuries, when partisans on both sides of the Reformation engaged in repeated and vicious wars to promote or defend their theological positions.

These cutting-edge 18th-century opinions still hold sway with a large number of contemporary thinkers. Richard Dawkins, for example, in “The God Delusion,” voices the opinion that religious belief persists in our time mainly because of bad parenting (i.e., parents teaching their children religion), and if only we could rid ourselves of this irrational belief in the supernatural, the world would quickly enjoy unprecedented peace and harmony.

The main problem with this whole line of thought is that it takes into account only a small part of the human psyche while denying and devaluing the rest.

This was already the response of the Romantic movement, which followed close on the heels of the Enlightenment and celebrated the emotions and fantasies that had been swept out of the tidy Neoclassical worldview of Locke and Smith. The Romantics restored “irrationality” to a place of value and usefulness, perhaps even giving it too high an estimation; these swings of the pendulum do tend to carry to extremes.

It’s a bit ironic that the rationalists of the Age of Reason looked to ancient philosophy for support for their arguments, because the ancients actually had a much more balanced view of human psychology. In particular, Plato and his followers clearly delineated the psyche into an irrational and a rational part, and though they did argue that the rational soul should rule the individual psyche, they contended that the psyche as a whole should aim to serve a higher, super-rational level of being. (To be technical, this “higher level” is called nous in Greek and is translated generally as “spirit” or “intellect,” depending on the inclinations of the translator; neither term really works very well, in my opinion.)

There are many, I’m sure, who will find it absurd to accord any value to irrationality. But consider: Are our sense-perceptions rational? Of course not; they simply report the facts of our environment to our emotions and our thinking. What about instincts? No, but they're pretty useful in keeping us from starving to death and so on.

What about emotions? Well, as Carl Jung pointed out, there is in fact a kind of emotional logic, which is why he defined "feeling" as a "rational function": We can rate and rank and judge things according to how they make us feel, good or bad, better or worse. And that kind of evaluation seems pretty important to our well-being. But in our modern worldview, dominated by the belief that “rationality” consists entirely of verbal or numerical logic, it doesn’t make the cut.

And let’s not forget the importance of irrationality in creativity, in making breakthroughs. Logical analysis just breaks things down or connects one existing thing to another; it doesn’t produce anything new.

However, ignoring or denying the existence or importance of these things doesn’t make them go away; instead, it simply sweeps them under the mental rug, into the unconscious – something else a lot of contemporary thinkers like to pretend is nonexistent. And from their lurking-place in our mental shadow, they can feed on our basic appetites and drives, and grow large and powerful enough to dominate us now and then, causing all sorts of embarrassing problems and bloody conflicts.

In addition, there’s a tendency toward the thoroughly unproven and frankly rather smug belief that “we” – that is, the intellectual inheritors of the Western (specifically, the Northwestern European) worldview – are the only really rational people, while “they” – all those mostly darker people in the rest of the world – are irrational (“medieval,” “emotionally volatile,” “politically immature,” etc. etc.) and therefore in need of our benevolent (of course) guidance (or the firm hand of a dictator chosen by us).

It scarcely needs to be said, but I’ll state that I don’t think “we” are as rational as some of us like to believe, nor are “they” as irrational. And in any case, I think we need to practice irrationality to some extent. You might say that the problem isn’t that we’re irrational, it’s that we just aren’t very good at it.

Sunday, November 9, 2008

Identity Theft

Moreover, how many choices do we really have? Religion, for example: There's a sort of menu of options ranging from highly traditional, fundamentalist sectarianism to outright materialistic atheism. The same sort of thing is true with politics. Sports: Pick a game, then choose a team to support. So identity-formation becomes like a meal in a Chinese restaurant: Pick one item from column A, one from column B, etc. And one person is a Baptist Republican Redskins fan who drives a Ford and likes Toby Keith, another is a Unitarian Democrat Yankees fan who drives a Toyota and listens to Tori Amos. I don't know how many such combinations are possible, but the number probably isn't very large, and some of the differences are pretty insignificant.

Worse still, we live in a world in which not just physical products are mass-produced, so are ideas, attitudes, styles, dreams. The products are marketed as a way of expressing who we are, and we buy them, and we also buy the premise that what we own, what we wear, what we drive expresses who we are. And maybe it does, and maybe it's not completely absurd to go to the mall to buy some individuality, but it certainly seems likely that we're limiting our possibilities that way.

If you've ever watched an older relative in the twilight of life, you've seen them seemingly fade away as they lose their grip on the attitudes, opinions, obsessions, addictions, preferences and finally the memories by which they defined themselves. What's left then, if that kind of self-definition is all they have? But who or what is it that made those choices in the first place?

Oh sure, I know, no two of us have the same fingerprints, except monozygotic twins. So yes, we're all unique in that sense - which means we're all the same, doesn't it?

Thursday, November 6, 2008

Pink-Slipped

Today’s 443-point drop in the Dow Jones Industrial Average is being attributed mainly to very weak October retail sales and gloomy earnings reports and forecasts. All of which is logical. But the decline is being said to have occurred “despite a decline in jobless claims.”

Well, no.

It’s true that the Bureau of Labor Statistics reported today that initial claims for unemployment insurance benefits fell 4,000 in the week ended Nov. 1 from the previous week – on a seasonally adjusted basis. But on a real basis – that is, based on the actual number of filings with state employment agencies – initial filings rose 3 percent.

Here’s the real picture, and it isn’t pretty:

(Click to enlarge)

What the chart shows is total claims for unemployment insurance benefits (that is, initial claims plus continued claims) this year to date vs. last year and vs. the average for the same week for the previous four decades. As is pretty obvious, this year is looking awful. In the latest week, ended Oct. 25 (continued claims are reported a week behind initial claims for some reason), total claims amounted to 3.77 million, the highest number for that week since 1982 and 1.2 million, or 47 percent, higher than the same week last year.

Another way of looking at it: Through the week ended Nov. 1 this year, 16.1 million Americans had filed initial claims for unemployment insurance benefits, 3 million more than in the same period last year, a 23 percent increase. In other words, layoffs this year are running about a fourth higher than last year, which already wasn’t exactly a great year.

So it shouldn’t come as a total surprise that retail sales are down, or that corporate earnings in general are down. The bean-counters at those corporations have prettied up their income statements by cutting costs – i.e., jobs – and the result is that sales have also fallen because those job cuts have led to less buying power on the part of consumers. This is pretty typical of the downside of every economic cycle, but that doesn’t make it any less illogical and self-defeating, nor does it lessen the pain of those people who’ve been tossed out.

Have any of the billions upon billions of our dollars that have been shoveled out to Wall Street and Detroit done any good for the average American? Not yet, obviously.

Wednesday, November 5, 2008

Breakthrough

The mainstream media - by which I mean all of the TV network news shows, the cable news stations and the newspapers I've seen - are making the lead on the election story the fact that Barack Obama is the first African American elected president of the United States.

That's certainly true, and it's also certainly noteworthy. But it's also a rather exclusionary and perhaps divisive way of stating what happened yesterday. So here's something else to think about: Barack Obama is the first person elected president of the United States whose ancestry is not solely or predominantly Northern European.

The vast majority of our presidents have been of English descent. Then there was Kennedy, who of course was Irish (as was Reagan), the Roosevelts (Dutch) and Eisenhower (German). But we've never had a president whose forebears hailed from any of the Southern European or Mediterranean countries (the only major-party nominee from that region that I know of was Michael Dukakis, who is second-generation Greek), let alone anywhere outside Europe.

In other words, throughout the history of this country, our image of what a U.S. president looks like has been a white (very white) male. But now, as the U.S. population grows more diverse, we've finally broken away from that stereotype. And given the power of the president as a symbolic figure, not only in public life but also in the psyches of individuals, that's a pretty momentous change - maybe the beginning of a complete reimagining of what this country is all about.

Monday, November 3, 2008

When Oilmen Ruled the World

As the saying goes, "One picture is worth a thousand words." This one might be worth several thousand (click to enlarge; in case it isn't clear, the light blue line is oil, the darker line is the Dow). What it shows is the cumulative daily percent change in the Dow Jones Industrial Average and the same calculation for New York Mercantile Exchange crude oil futures, from Jan. 22, 2001, through last Tuesday (the most recent date for which the U.S. Department of Energy could provide crude prices).

In other words, the chart shows what an equal investment in the Dow and in oil would have returned on any given day since then, up to last week. Obviously, except for the first three years, oil would have been a much better investment than the stock market. Even after the steep decline from last summer's all-time high (when oil was up a staggering 65 percent while the Dow was up a piddly 9 percent), it's still up 29 percent overall. As of Monday's close, the Dow is down 5.5 percent over the same period.

The significance of the starting date, of course, is that it was the first trading day after George W. Bush was sworn in as president.

The Good, the Bad and the Evil

Part of the reason people and churches have such a hard time with this issue is that the question isn’t expressed very well; the terms are ill-defined. Part of the fault for that lies with fundamentalists of the Pat Robertson or Jerry Falwell stripe, who tell us, for example, that Hurricane Hugo was God’s way of punishing New Orleans for its stubborn immorality.

What that sort of claim fails to recognize is that there are two kinds of good, and two kinds of bad: practical and ethical. On a practical level, Hugo was very bad for New Orleans, but whether New Orleans’ prior behavior was ethically bad is a subject that’s open to debate.

Another example may serve to clarify the distinction: Somewhere in the cold, snowy forest, a wolf catches a rabbit and eats it. This is very good for the wolf, very bad for the rabbit, and for the same reason in both cases: because life is good; that is, to have life, to be alive, is good. So for the rabbit to lose its life is as bad as it gets, on a practical level, while for the wolf, eating the rabbit helps sustain its own life, so that’s good.

As a loose definition, let’s say a “practical good” is anything that produces, sustains or improves life for whatever living thing has this good, while a “practical bad” is anything that injures or otherwise causes suffering in or shortens the life of the living thing that has that.

Where the moral or ethical dimension enters the fray is in the question of intent. No rational observer, for example, would suggest that our wolf killed our rabbit purely with the intent to harm it. Rather, the wolf’s intent (as far as that word can apply to a four-legged mammal) was to get a meal by the only means available to it; harming the rabbit was its only option.

As for Hurricane Hugo, no rational person would claim that a hurricane is capable of forming an intention to target a particular coastal region. Less easily dismissed, perhaps, is the notion that God – who presumably is capable of forming an intention – conjured up this storm and used it to express his displeasure toward the ostensibly loose morals of the Big Easy.

Leaving that aside for the moment, however, we might look around to see who else is capable of forming intentions of a similar type, for good or ill. And that would be us, of course: human beings.

To summarize: Practical goods or ills can come about because of purely natural events or processes, but moral goods or ills come about only through the decisions and actions of human beings (and perhaps gods).

Ancient religious writings tend to refer willy-nilly to harmful things as “evil” or “ill” or the like, without distinguishing the accidental or practical from the intentional and immoral. To avoid confusion, I’ll use the words “bad” or “ill” to refer to harm caused by natural processes, broadly speaking (which can include some psychological and social processes), and the word “evil” to designate the deliberate or unconscionably reckless infliction of harm by entities capable of thinking.

Now we can break the question of theodicy down into two parts.

First, why would a good and just god create a world in which natural events or processes sometimes cause harm to living things?

The answer to that one is quite obvious: because no other kind of world can produce or support life. For example, an atmosphere that enables living things like those on Earth to breathe, and therefore to live, must be dynamic; if it were to cease moving and changing, it would rapidly become unbreathable. Similarly with the Earth’s waters: Stop them from flowing, and they would quickly become poisonous. To put it a bit crudely, the occasional hurricane or tornado or flood is the price we must pay for having life in the first place.

Many traditional religious or philosophical systems acknowledge this as fundamental to the nature of the cosmos: Hinduism, with its cycles of creation and destruction; Buddhism, with its key recognition of “impermanence” as the essential character of material existence; Greek philosophy, with Heraclitus’ famous teaching that “Nothing is constant save change” and the idea that all physical things are either coming to be or passing away; and of course Taoism, with its teaching of the interplay of yin and yang and its Book of Changes. But in systems that posit a deity who’s prone to fits of anger, we find an inexplicable belief that storms or whirlwinds or deluges are somehow unnatural, and are visited upon the world only to chastise a rebarbative humanity – a bizarre projection of moral concerns onto the purely practical.

Now for the second part of the question: Why would a good and just god create beings who can intentionally cause harm to other beings for no good reason; that is, who are capable of doing evil (as defined above)?

Let’s return to the wolf and rabbit I mentioned earlier. The reason the wolf’s killing of the rabbit contains no moral or ethical component, as I said, is because the wolf has no capacity to form a different intention: If the wolf wants to live, it must eat the occasional rabbit. It cannot choose not to harm the rabbit.

But now suppose a different sort of creature, one that can choose not to harm rabbits, even when it’s hungry; in other words, a creature that can choose to bestow something good (life) instead of bestowing something bad (the loss of life). Being capable of making that choice is what renders this creature a moral or ethical being; if the choice were taken away, if this creature were allowed only to do good, then it would be no more a moral being than the wolf.

So to answer the second question, if beings are to exist who can intentionally do good for other beings, then they also must have the ability to do evil, and the responsibility for choosing the one over the other is theirs, not God’s. Or as Alexander Solzhenitsyn put it, “The line between good and evil runs straight through the middle of each human heart.”

What I’m saying, in sum, is that as far as good and bad, or good and evil, are concerned, we can leave God out of the question, even if we want to credit him or her or it as First Cause: We exist because the cosmos is the kind of constantly moving, changing thing it is, and wishing it were otherwise would be to wish ourselves out of existence. What we should be wishing instead is that we and those around us would prefer to contribute to the good in each other’s lives instead of adding to each other's suffering; in other words, that we might approach life and our fellow beings with goodwill, not ill-will.

Ill-will, then, is about as purely evil as anything can be said to be. Conversely, pure goodwill – unselfishly wishing good for others, without seeking or expecting any sort of reward or payback, out of nothing but the love of humankind (that’s “philanthropos” in Greek) – is, as far as I can see, the highest good of which a human being is capable.

Saturday, November 1, 2008

Put to the Test

As that story, written by John Thavis, explains, a document released by the Vatican on Oct. 30 says “seminary candidates should undergo psychological evaluations whenever there is a suspicion of personality disturbances or serious doubts about their ability to live a celibate life.” The document, “Guidelines for the Use of Psychology in the Admission and Formation of Candidates for the Priesthood,” doesn’t sanction routine psychological testing for all seminarians; rather, it says, “the use of psychological consultation and testing [is] appropriate in ‘exceptional cases that present particular difficulties’ in seminary admission and formation,” according to Thavis.

However, during a press conference announcing the policy document, Thavis writes, “Archbishop Jean-Louis Brugues, secretary of the congregation, said that, in fact, many dioceses currently have mandatory psychological evaluations for candidates to seminaries.”

Naturally, all of this is linked to the scandal of sexual abuse by priests that has been widely reported over the past several years, and much of the coverage of this week’s announcement has assumed that the new policy is meant to stop homosexuals from being ordained. (“Vatican: Screen for possible gay priests” was the headline on the Seattle Times online story.)

That’s not what I find perplexing. Here’s where I’m having problems:

The word “psychology” is of course Greek in origin and derives from “psyche,” meaning “soul” and “logos,” meaning “word” but also, as I’ve discussed previously, “description,” “explanation,” and so on. So the literal meaning can be taken as “study of the soul.”

As we all know, the Catholic Church has held itself out for almost two millennia as the authority par excellence on the soul and matters pertaining thereto. And it has a long-established “psychology,” largely adapted – through such church fathers as Origen and Clement of Alexandria, Ambrose and Augustine, and pseudo-Dionysius the Areopagite – from Platonism.

But while the “psychological consultation and testing” now being proposed, and the “mandatory psychological evaluations” already being practiced aren’t specified, it does sound rather like the church is now conceding that the modern materialistic-mechanistic psychiatric/psychological establishment is a better evaluator than it is of men’s souls. (Not women’s, because of course the Vatican still refuses to countenance the ordination of women.)

The Catholic Church has, for about a century now, been relatively accommodating toward science, unlike the more fundamentalist sects that, for example, deny the reality of the evolution of species by natural selection. Some of that may be a result of lingering embarrassment over its despicable treatment of Galileo and Giordano Bruno and so on. But this latest concession may be going too far.

Psychology these days pretty much has discarded the psyche. In fact, many practitioners have dropped that term and prefer to be called behaviorists. The consensus (leaving out Jungians, who are widely derided as “mystical”) seems to be that the mind is nothing but a sort of secretion of the brain, and any abnormal behaviors – the “disorders” that seem so numerous these days – can easily be fixed through chemical modification. So “psychological evaluation” consists basically of seeing which set of symptoms in the Diagnostic and Statistical Manual a person matches, and treatment consists of selecting the right medication to “control” it – because no “cure” is possible.

Now, I’m not suggesting that the church shouldn’t do something to prevent pedophiles from becoming priests. I’m just saying there may be better ways to solve this problem. One rather obvious example: Until about the 12th century, priests were allowed to be married and have families; it was only with the reform movement led by Bernard of Clairvaux and others that a monastic-type celibacy was universally prescribed for parish priests. Other religions allow, and even encourage, their clergy to marry, and don’t seem to have such widespread problems with sexual misconduct.

There’s also a very long-standing system of what one might call “vetting” that might be more harmonious with the church’s mission as a spiritual organization. This system was practiced in the Greek philosophical schools and the early Christian monasteries, and it continues to be practiced today in Eastern Orthodox and Buddhist monasticism, and the Sufi schools.

In all these traditions, students or aspirants or candidates for initiation or whatever must undergo a lengthy period of what one might call “spiritual apprenticeship” under the watchful eyes of a community of aspirants who are undertaking the same struggle. The emphasis from the outset is on ethics: the cultivation of virtue and the eradication of vice; only when the school’s leaders are satisfied with the genuineness of the aspirant’s progress is he or she led to the next level of practice.

While there are still some vestiges of this tradition in Catholic monasticism (reflected to a degree in the works of Thomas Merton), the church doesn't especially encourage either its clergy or its laity to undertake this sort of inner conquest of the Self. Instead, like other Christian sects, it turns its energies, and those of its members, toward worldly affairs and outer victories.

Viewed that way, this announcement about psychological testing makes perfect sense: In a world obsessed with appearances, it gives the appearance that the church is doing something decisive about a festering problem. But from another perspective, one might conclude that the church itself is failing a test and paying the price for neglecting its own soul.

Friday, October 31, 2008

Still Here

It has occurred to me that anyone who was drawn to this blog by my philosophical divagations might find it a little startling when I suddenly post a stock market chart and analyze it. So I thought I’d mention that this isn’t my first blog. From last April until mid-September, I maintained a finance blog for The Post and Courier of Charleston, S.C., where I was assistant business editor the past five years.

That blog is still archived there, and anyone who’s interested can browse the postings. For example, I expressed some thoughts back in July on the unfolding financial crisis, the bear market in stocks and the fundamental inadequacy of the U.S. government’s response. And for anyone who thinks U.S. corporations are too heavily taxed, there’s this entry.

I'll be back with some fresh stuff soon.

Tuesday, October 28, 2008

No Bull

In the Wall Street mainstream, unfortunately, the current understanding of what constitutes a bull or bear market is pretty superficial. Many analysts and financial journalists insist that a bear market is a decline of 20 percent or more, which is an arbitrary, meaningless and ultimately useless way of looking at the market.

If bull/bear really is equivalent to yin/yang, then there must be fundamental qualitative differences between bull and bear markets; it isn’t just a matter of whether the market is going up or going down. And there are a number of technical analysts who have said just that for many years, arguing that bull markets are structurally different from bear markets, and noting that, for example, a rally can occur within an ongoing bear market without reversing the overall trend.

One example that has been noted fairly widely: Bear markets tend to move faster than bull markets; that is, the market falls by larger increments and in less time than it rises in bull markets. And even a fairly superficial look at the data supplies some confirmation of this view. Using a database of daily closing prices for the Dow Jones Industrial Average from 1896 to the present, the average percentage change on up days has been 0.750 percent, while the average change on down days has been 0.774 percent. On the other hand, 52 percent of all trading days have seen advances, while 47 percent have seen declines, with about a half-percent showing no change.

It occurred to me that there might be a way to use this information as a sort of trend indicator. What I did was compare the 20-day median percent change in the index with the overall average of up days (i.e., 0.750 percent) and the equivalent average for all down days (0.774 percent). Then I plotted all days when the current 20-day median was above the up average or below the down average. Here’s the result, along with the Dow for comparison:

I'm sorry the dates aren't clearer; I'm just learning to use the image upload on this site. But two things jump out from this chart. First, periods when the 20-day average change is above or below the long-term up or down average are fairly rare. Second, we’re in one of those periods right now.

That’s right: Starting on Oct. 10, the 20-day median percent change in the Dow fell below the 118-year average for down days, and it has continued to fall further below it, as of Monday’s close. It’s now about a full percentage point below the long-term average and is at the lowest level since early 1932, during the worst of the fierce 1929-32 bear market.

I don’t know whether this bull/bear indicator has any predictive value, but there is one thing that might be worth noting: In general, the lowest readings on this indicator have coincided with the steepest phases of bear-market declines – NOT with the end of the decline. So even if we were to take an optimistic view that this indicator has reached its lowest point, it still wouldn’t preclude the Dow from falling significantly lower.

Update 4:35 p.m.:

Today's 889-point jump in the Dow had no effect on the bull/bear indicator described above. In general, all it did was carry it back toward the upper end of the downward-tending trading range it has been in for the past three weeks.

Also, a little more explanation about the chart above: Ostensibly bullish moves are those above the zero line, shown in red to represent "fiery yang energy," as they say; bearish moves are those below the zero line and are shown in blue, representing "cool, watery yin energy."

Sunday, October 26, 2008

Loose Morals

But what difference does it make? What does it matter if scientists and economists and so on are working from a faulty conception of the overall cause and meaning of the cosmos? As long as they get the lower-level details right, and the electricity still makes my lights work and I can still click a link and look at stuff on the Internet, is there any reason to care about overarching theoretical stuff that may not be provable anyway?

Well, certainly in the case of economics, we’re seeing what happens when a wrong theory holds sway: Vast sums of money vanish in the blink of an eye, people lose their jobs, and political consequences follow.

In physics, there’s apparently some possibility that we might see even more disastrous results in a few months, when the big new CERN supercollider is fired up again, after it blew a fuse on the first try several weeks ago. Some physicists have expressed concerns that when their colleagues start smashing tiny bits of matter together, it might possibly cause the end of the world. Others scoff at that idea, though; I guess we’ll find out who’s right eventually.

However, I think we’re already living every day with almost equally disastrous results from this materialist-atomist worldview, because it leaves us with no “higher good,” no center-of-the-universe, no focus. What we’re left with is an absurdist value-neutral universe in which every action is pretty much as valid as any other. If, as Nietzsche proclaimed, “God is dead,” then by what standard do we judge our own or others’ words and actions?

The answer for Nietzsche and many others: the individual will, or what a lot of people might prefer to call the personal ego. From that perspective, “good” is what’s good for me, “bad” is what’s bad for me.

Amazingly enough, this position is in fact the stance of orthodox economics, though in that discipline the concept is sugar-coated with the notion of “rational agency,” which in essence claims that people (or at least those who make economic decisions such as whether to buy or sell stuff) act out of what some refer to as “enlightened self-interest.” Meaning that people are generally aware that the effect of their decisions on other people is something they need to keep in mind; for example, if you’re stealing food from others, you need to leave them enough so they don’t starve to death, if you want to be able to keep stealing from them.

But as we’ve seen in the banking industry, some people don’t get that part of the theory; instead, in their egotistical greed, they’re willing to burn their own house down to keep the fires lit. “Rationality” wouldn’t seem to have much to do with it, except in the sense that some of them were able to find plausible-sounding rationalizations for what they were doing.

Now, I’m not aligning with those upholders of religious orthodoxy who decry “situational ethics” and “moral relativism.” I think any ethics that doesn’t vary somewhat depending on the situation is too limited to be valid, and I think all morality is relative – relative to the true, final good.

I don’t agree, either, with those who claim it’s possible to establish a valid ethical system on a purely materialistic-scientistic basis. Any moral system that posits the “highest good” as some physical thing – prosperity, social order, the pursuit of scientific knowledge – will lead eventually to immoral results. For example, if you suppose that the highest human good is social order, you’ll inevitably end up making utilitarian compromises, seeking “the greatest good for the greatest number,” which means some “lesser number” will be hauled off to prison whenever it’s convenient, without violating your moral rules.

As for “scientific knowledge” as a “highest good,” it sounds nice and noble, but of course in the real world, research gets done when someone – the Pentagon, the pharmaceutical companies, the cigarette makers, etc. etc. – is willing to fund it.

So is there a way to find the true “highest good,” and to do so objectively, without recourse to traditional authority, such as religious dogma? I believe there is, and I’ll go into detail in a posting in the next few days.

Right now, I’d like to make a brief comment about reader comments. I’m delighted anytime anyone wants to leave a comment here. I’ve set it up so you don’t have to register or anything like that. I do say things from time to time that I think are fairly provocative, and I don’t mind anyone disagreeing or criticizing or challenging any of it. However, I won’t allow obscenity, libel or hate speech. So please feel free to critique, but please be grown-up about it.

Thursday, October 23, 2008

Gloom and Doom

There are two main reasons, I think, why this random model came to be prevalent. The first is Darwinism, which holds that species evolve as a result of random genetic mutations. The second is physics, which models matter as “particles” that interact randomly. I could also throw in the concept of entropy, a consequence of the second law of thermodynamics, which Victorian physicists first theorized would lead eventually to the “heat death” of the universe.

All of these things together produced an astonishing pessimism among the intellectual elite of the late 19th century, epitomized by Matthew Arnold’s marvelously gloomy 1867 poem “Dover Beach”:

Ah, love, let us be true

To one another! for the world, which seems

To lie before us like a land of dreams,

So various, so beautiful, so new,

Hath really neither joy, nor love, nor light,

Nor certitude, nor peace, nor help for pain;

And we are here as on a darkling plain

Swept with confused alarms of struggle and flight,

Where ignorant armies clash by night.

As I indicated the other day, I think the emphasis on randomness (as well as the gloom) is overwrought, to say the least. Even granting that, for example, atoms in an unconfined space move and interact randomly, as soon as they do interact, various natural laws and forces (gravity, the strong and weak nuclear forces, etc.) come into play to create structure. Similarly, even if a new, more “advanced” species emerges as a result of a random genetic mutation, that species’ existence (and success) increases the likelihood that a future mutation will produce an even more advanced and successful species.

An analogy: Suppose a rainstorm forms directly above the Continental Divide. The individual raindrops will fall randomly around the divide. But as soon as each drop hits the ground, gravity and geology kick in, and the pathways those drops take from that point on are predictable: They will flow either to the Atlantic Ocean or the Pacific (leaving out evaporation, absorption, being swallowed by grizzly bears, etc.).

Similarly, the widely held Big Bang model in cosmology holds that the initial state of the universe was a hot fog of more or less randomly distributed particles. But natural laws have gradually drawn matter into recognizable patterns or structures – galaxies, clusters of galaxies, stars, planets, etc.

Another way of putting it: The proponents of randomness claim the natural state of matter (and energy) is “equilibrium” – basically a more or less uniform distribution. That state may be disturbed occasionally by random events (stars colliding and so on), but it always returns eventually to equilibrium.

In contrast, researchers in recent decades (Nobel Prize laureate Ilya Prigogine, for example) have noted and analyzed the many instances of systems that are, as they say, “far from equilibrium” – that is, they exhibit self-sustaining and self-reproducing non-randomness. Today, there’s lots of interesting work being done on studying complex systems and creating models that take account of the wholeness of objects instead of breaking them down atomistically; one place to see some of that work is the Web site of the Center for Integral Science.

Despite these developments, mainstream economists continue to insist that financial markets are well-modeled as a random process. The leading proponent of this view is Burton G. Malkiel, a Princeton economics professor whose book “A Random Walk Down Wall Street” remains the Bible of this viewpoint. In essence, Malkiel claims financial markets tend toward equilibrium because all investors (the “particles” in this model, characterized as “rational agents” who seek to “maximize their personal good”) have access to the same information. Occasional “shocks” caused by the introduction of new information, or other “inefficiencies,” are quickly damped out as investors adjust. As a result, fluctuations in the markets are random and unpredictable, so it’s impossible to “beat the market” through timing or other strategies.

It’s a nice, neat, self-consistent theory, but in the four decades since Malkiel first published the book, there has been abundant research showing that the random walk doesn’t actually provide a good model of market behavior. A search for the phrase “random walk” in the Research Papers in Economics online IDEAS database produces one study after another showing that the random walk hypothesis fails when applied to a wide range of financial markets.

Even so, random walk theory continues to be taught in economics classes. (Malkiel himself remains unrepentant, or maybe he just isn’t keeping up with the literature; I interviewed him in the early 1990s and asked him whether any of the then-emerging criticisms of his theory from the perspective of nonlinear dynamics/“chaos theory” had given him pause, and he responded by talking about the so-called January Effect, which has nothing to do with nonlinearity.) One result is that when the stock market jumps 900 points one day and plummets 400 the next, everyone seems astounded, and we hear the so-called experts “explaining” these moves in terms of that day’s news headlines.

The alternative – or “an” alternative, at least – would be to acknowledge that financial markets exhibit some sort of orderly structure. That’s a claim that has long been made by a variety of non-academic observers and analysts (Elliott Wave Theory is a notable example). If true, the identification of the details of that order would have potentially enormously profitable implications. So far, if anyone has figured it out completely, they aren’t telling.

Wednesday, October 22, 2008

Just Gimme Some Truth

“Pilate said to him, What is truth?” (Jn. 18: 37-38)

This passage from the Gospel of John (chapter 18, verses 37-38) has been on my mind a lot lately, maybe because of the inexcusably prolonged presidential campaign, maybe because I’ve had to spend a lot of time the past few years dealing with marketing and PR people.

In John’s book, Jesus doesn’t answer Pilate’s question. In fact, Pilate doesn’t actually give him an opportunity to answer; it’s a truly rhetorical question. Here we have an upper-class Roman interrogating a Jewish laborer-cum-holy-man and not wanting to bandy words with him; as a presumably well-educated man of his time, Pilate has heard or read the extensive philosophical discussions of “truth” and isn’t interested in hearing some backwater crackpot’s views on the subject.